The digital platform to accelerate your wealth management vision

Nucoro is the foundation to quickly build, automate and scale digital investment propositions. Whether building from scratch or integrating new propositions, the platform is the orchestration layer to get you to market quickly.

Build digital investment products with ease

Create and automate digital savings and investment services for your clients and implement them with ease and flexibility thanks to the Nucoro Platform’s powerful APIs.

Automate end-to-end

The hyper-automation of the platform unlocks maximum digital potential for propositions and reduces overall unit cost to a bare minimum.

Integrate seamlessly with existing systems

Integrate and leverage pre-integrated and new solutions for custody, data, engagement and more thanks to best-in-class APIs and the Platform’s modular approach.

Scale with a modular, cloud-based architecture

Our scalable cloud-native platform adapts dynamically to any number of users and allows you to scale your business with a much higher profitability in operations.

The value of the platform

Unique speed to value

Speed up your time to market and accomplish 85% of your vision purely through platform configuration, underpinned with the highest security standards at every step.

Exceptionally automated

With our expertise and fully automated business logic across the whole investment lifecycle, the operations run themselves freeing our clients to increase the level of service to their customers.

Easy integrations

Incorporate savings and investing propositions into existing channels or build greenfield applications easily using Nucoro’s RESTful APIs.

Fully configurable

Nucoro’s loosely coupled modules provide you with the flexibility you need to compose digital investing services and create unique value propositions that run in the cloud.

Platform modules

Client book

Single source of truth storage of personal data, account information and tax details.

KYC/AML verifications

One-off and recurring verification of identities and bank accounts and third-party provider management.

Risk profiling

Configurations or risk questionnaires and suitability assessments and gapless assessment history.

Communication & Engagement

Omni-channel notification engine, referral processes and content management system.

Documents & Contracting

Storage of digital signatures, auto-generation of contracts and repositories for client documents.

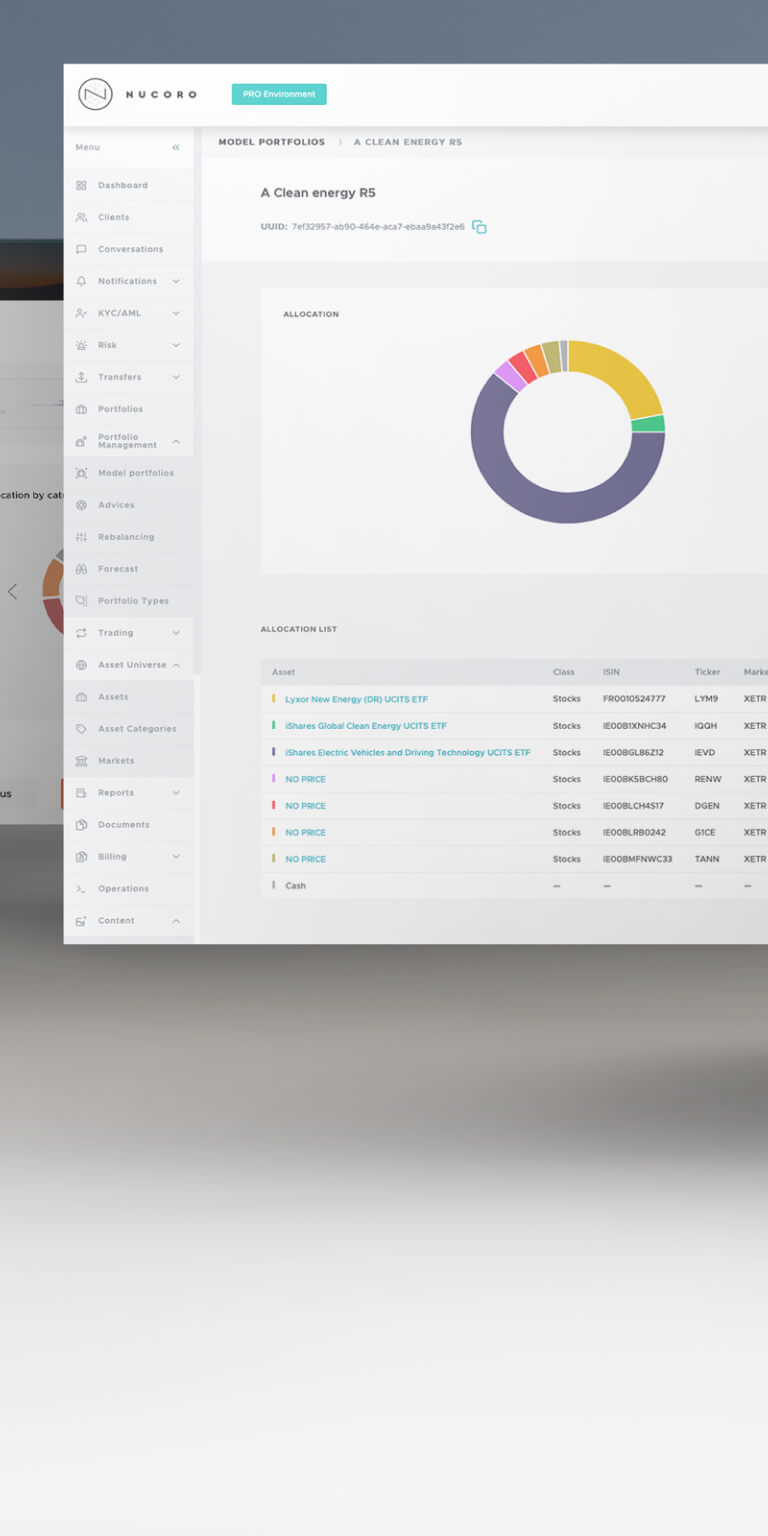

Asset universe

Multi-market configurations, flexible categorisations of asset details and prices and market/price data management.

Portfolio management

Configuration of model portfolios, automated advice engine and external provider management.

Rebalancing engine

Scheduling and configuration of constraints, pre/post trading checks, order generation, drift management and rebalance monitoring.

Account management

General investment accounts, tax wrapper configuration, contribution limits and transfer rules.

Account reporting

Definition of performance metrics, valuation and position reports, analytics tools and activity reporting.

Planning & goals

Scenario forecasting, setting, tracking and management of investing and saving goals.

Custodian engine

Infrastructures for omnibus and segregated accounts, support for multi currency and multi custodian setups.

Reconciliation engine

EoD valuation records, cash position and corporate actions reconciliation.

Brokerage engine

Support for fractional shares, trade aggregation, netting and external broker management.

Transfers

Automation of deposits, withdrawals and management of external payment provider integrations.

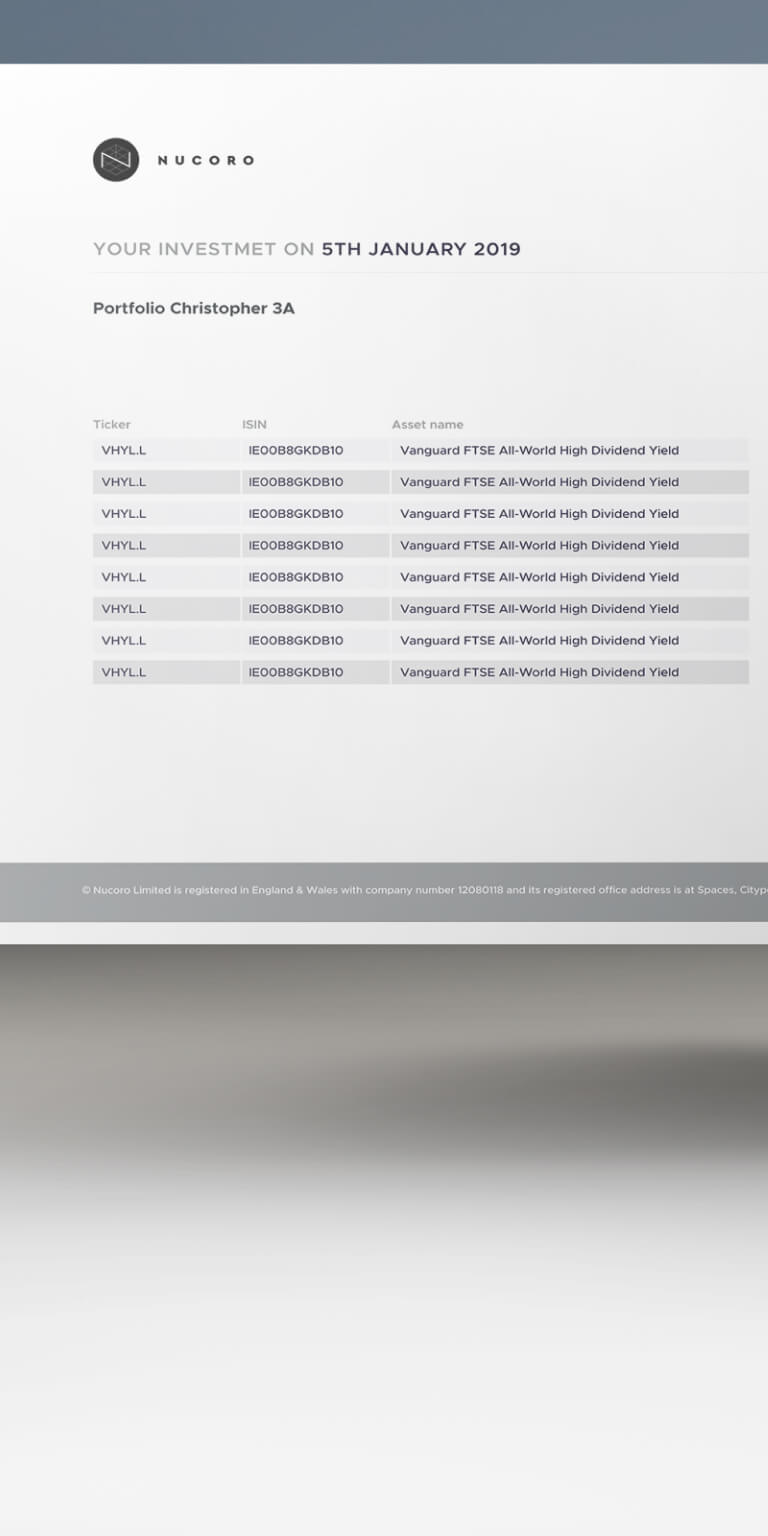

Reporting engine

Client statement and tax reporting, regulatory reporting and gapless audit trail.

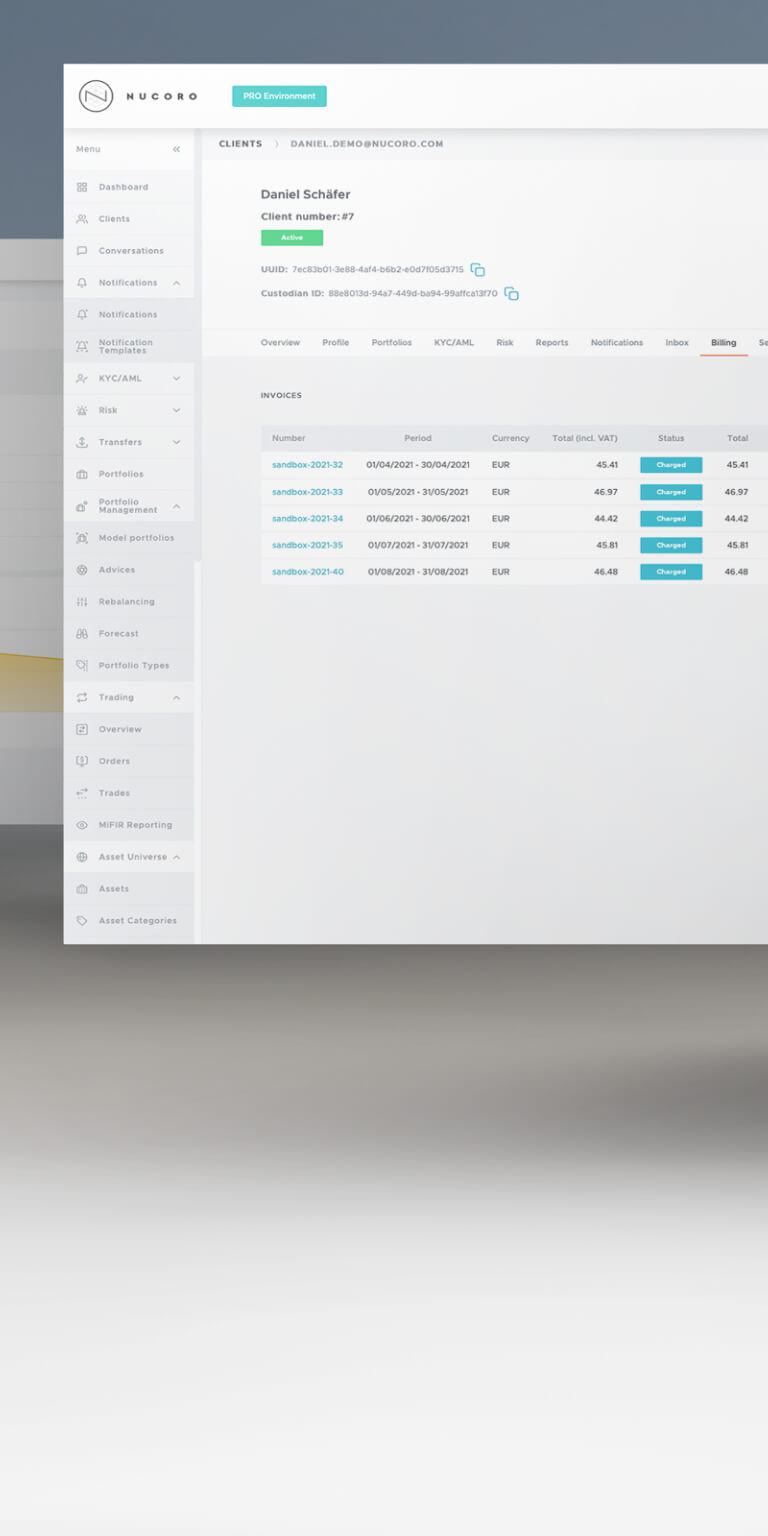

Billing engine

Administration of portal fees, setting of custom client fee schedules and invoice generation.

Global configuration

Configuration of client and staff portals and management of the entire cloud infrastructure.

Security & compliance

Oauth, 2-F authentication, Token JWT, gapless access logs for users and business teams and limitless process tracking.

Roles & permissions

Creation of users and definition of administrator and user functions and permissions.

Analytics

Business and management dashboards, whole-of-record asset overview and global portfolio analysis tools.

Scalable infrastructure, now and in the future

However much you grow, Nucoro grows with you. With AWS or Azure deployment options, we cover the largest cloud providers used in the financial services industry, allowing us to deploy new platform environments with different sizes, configurations and in different world regions within minutes.

Horizontally scalable

The Nucoro Platform can efficiently run propositions and services of any size. Its horizontal-scaling allows it to adapt automatically to extremely high loads.

High availability

The Platform is set up in high-availability mode with redundant cloud resources. It runs in multiple data-centers concurrently and no downtime is incurred for updates.

Continuous delivery

System updates are fully integrated with Nucoro’s development, testing and delivery tools. The Platform can be automatically and regularly updated without any service disruptions.

Highest security standards

Our technology features the highest protection standards to ensure continuous delivery and full compliance. Embrace innovation without compromising on security. The Nucoro Platform has been designed for security from the ground up, is regularly audited and is ISO 27001 certified.

Isolated environments

Each platform environment is deployed within a logically isolated Virtual Private Cloud (VPC). Tenants are separated at the cloud account level.

Created for multiple regulatory environments

Financial institutions worldwide leverage the Nucoro Platform to power digital financial services regulated by the FCA, FINMA, CNMV and other regulators.

SLA and business continuity

Nucoro provides a 99.9% SLA for uptime. In order to achieve the highest security we operate our Information Security Management System (ISMS) according to ISO 27001.

Security auditing and pentesting

The Nucoro Platform undergoes a periodic security audit conducted by an independent third-party security firm and operates at the highest standard in encryption and data management. Pentesting includes grey-box and black-box vulnerability assessments following OWASP.

Built for developers

Our Developer Portal contains API documentation, development resources and a sandbox environment for your development teams to start building and integrating with the Nucoro Platform.

Apply for a Dev Account

RESTful APIs

Simple to use, powerful RESTful APIs allow your developers to integrate in days, not months.

SDKs

OpenAPI specification available and SDKs for different programming languages.

Front-end experiences

Reference front-end experiences can be used to build web-based or mobile hybrid applications.

Why work with Nucoro

Whether you want to launch a robo investment proposition from existing templates or build a customised hybrid digital wealth management solution, Nucoro is the place to start.

We understand from experience

From an AI-driven investment platform with Exo Investing, to a hybrid advisory platform for Edmond de Rothschild, we understand your project, the potential bumps in the road and how to get past them.

Technology that gets you there faster

The Platform has pre-integrated third parties for core banking systems, existing configurations for tax wrappers and local regulations, and production-ready reference front-end experiences for web and mobile applications to speed up time to market.

A team by your side

Our people are experts in technology, investment management and operations and will work with your in-house teams from project inception to delivery and beyond, wherever you are in the world.